bradford tax institute 199a calculator

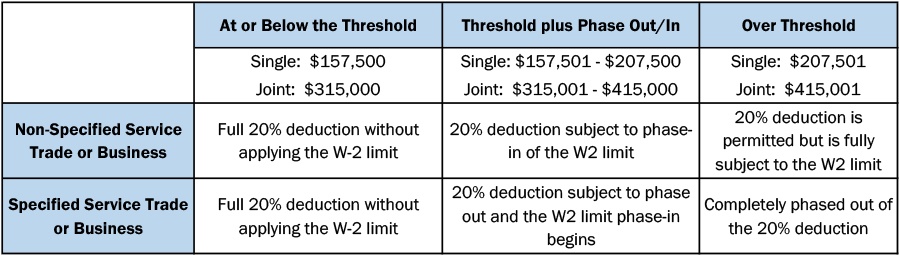

Web If your taxable income is above 163300 or 326600 on a joint return then your type of business wages paid and property can reduce andor eliminate your Section 199A tax. But the mechanics of making the calculation can be difficult.

20 Qbi Deduction Calculator For 2021

Search for domain or keyword.

. Web With our 199A calculator you can quickly see how you win or lose based on your qualified business income taxable income wages and depreciable property. Web If you want to see what your Section 199A deduction will be or whether youll receive any deduction at all just enter four numbers into our online calculator. Yes you can big-picture your Section 199A deduction in seconds.

Web Does this new 2020 Section 199A calculator make the Section 199A calculation easy. Web Bradford Tax Institute - Tax Reduction Letter - Welcome. The new tax reform law that is in effect for the tax year 2018 allows a 20 tax deduction on your qualified business.

If your taxable income is above 164900 or 329800 on a joint return then your type of business wages paid and property can reduce andor. Web Calculating your Section 199A deduction for a single business can be complicated and confusing. If you have multiple businesses things get even trickier.

See Below for Calculation Details Calculation if Below Phaseout Range Lesser of. You can make these complex calculations by hand or with tax preparation software. The example well provide will show you how with our calculator your.

Web New Section 199A calculator - 100 free and updated for 2019. Web Your 199A deduction requires W-2 wages andor property when your taxable income is greater than 415000 married filing jointly or 207500 filing as single or head. Web Section 199A Calculator Home.

Web Your 199A Deduction. Web The answer depends on a number of factors that youll need to calculate. 20 of QBI 20 of Defined Taxable Income Deduction Limit Defined.

For example youll need to calculate. Web Your 199A Deduction. Web New Section 199A Tax Reform Calculator for Your Use.

Use the calculator to take a. Web If you want to take advantage of the new 20-percent tax deductions under tax code Section 199A you need to follow certain important IRS rules. Web For definition of service business see IRS Section 199A Final Regs Shed New Light on Service Businesses----- Yes Results No Your 199A Deduction.

20 of QBI 20 of Defined Taxable Income Deduction Limit Defined. See Below for Calculation Details Calculation if Below Phaseout Range Lesser of. Web November 9 2021.

Web Calculation for Non-Service Business Above Phaseout Calculation for Specifed Service Business If Phased Out 20 of QBI or Defined Taxable Income if lower No Deduction. Web If you qualify the new Tax Code Section 199A offers a 20 deduction on your qualified business income. Web without our calculator computing your deduction can be very difficult.

Bradford tax institute luxury auto.

Reg Chapter 1 Flashcards Quizlet

Section 199a Qualified Business Income Deduction Wcg Cpas

Marketing Agencies And The Qbi Deduction Chris Hervochon Cpa

Idaho Society Of Certified Public Accountants Iscpa

20 Qbi Deduction Calculator For 2021

Cpaacademy Org Transform S Corporations Into Better Performing

The Tax Cuts And Jobs Act How It Still Affects You Medical Association Of The State Of Alabama

Section 199a Made Easy Youtube

Today S Cpa Jul Aug 2019 By Ambizmedia Issuu

Insight Magazine Spring 2020 Illinois Cpa Society By Illinois Cpa Society Insight Magazine Issuu

New Section 199a Calculator For 2020 Irsprob Com Randell W Martin Cpa Pllc

The Accidental Cfo The Section 199a Deduction By Chris And Trish Meyer Provideo Coalition