sales tax rate in tulsa ok

The latest sales tax rate for Tulsa OK. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax.

Harper County Voters Face Permanent 1 Sales Tax Hike

The Bixby Oklahoma sales tax is 892 consisting of 450 Oklahoma state sales tax and 442 Bixby local sales taxesThe local sales tax consists of a 037 county sales tax and a 405 city sales tax.

. State of Oklahoma 45 Tulsa County 0367 City 365. The December 2020 total local sales tax rate was also 4867. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

2021 Tulsa County Tax Rates. The countys average effective property tax rate of 113 is. Some cities and local governments in Tulsa County collect additional local sales taxes which can.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. The December 2020 total local sales tax rate was also 8517.

The most populous zip code in Tulsa County Oklahoma is. What is the sales tax rate in New Tulsa Oklahoma. State of Oklahoma - 45.

This is the total of state county and city sales tax rates. You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables. Did South Dakota v.

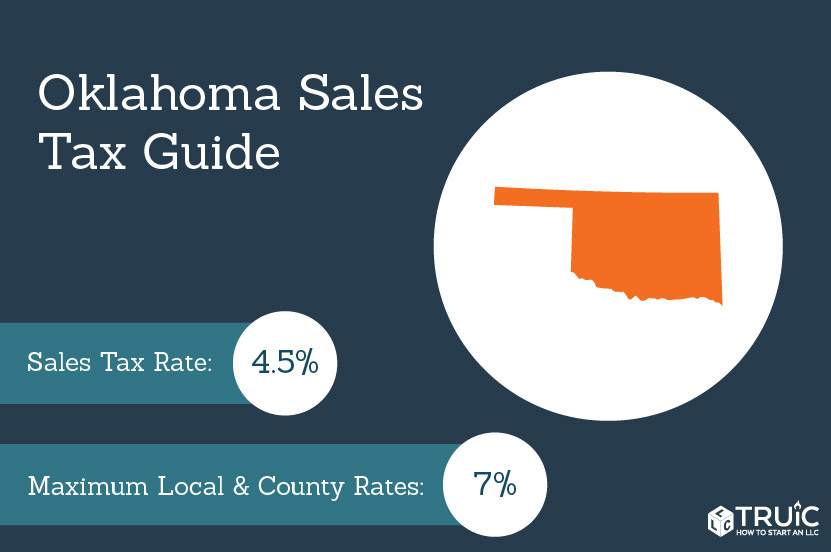

Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65. There is no applicable special tax. The Oklahoma state sales tax rate is currently.

Avalara provides supported pre-built integration. As far as all cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard. Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax.

The 2018 United States Supreme Court decision in South Dakota v. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037. This rate includes any state county city and local sales taxes.

Tulsa County - 0367. The County sales tax rate is. To review the rules in.

What is the sales tax rate in Claremore OK. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766. The Tulsa County Sales Tax is collected by the merchant on all qualifying sales made within Tulsa County.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. The most populous location in Tulsa County Oklahoma is Tulsa. How much is tax by the dollar in Tulsa Oklahoma.

The latest sales tax rates for cities in Oklahoma OK state. The Oklahoma sales tax rate is currently. 608 rows 2022 List of Oklahoma Local Sales Tax Rates.

The New Tulsa sales tax rate is. You can print a 8517 sales tax table here. What is the sales tax rate in Tulsa OK.

Sales tax at 365. 11 to capital fund. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The latest sales tax rate for Tulsa OK.

The total sales tax rate charged within the city limits of Claremore is 9333. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax. Tulsa County 0367.

The minimum combined 2022 sales tax rate for New Tulsa Oklahoma is. The Oklahoma state sales tax rate is currently. 2 to general fund.

Heres how Tulsa Countys maximum sales tax rate of 10633 compares to other counties around the. Has impacted many state nexus laws and sales tax collection requirements. 2020 rates included for use while preparing your income tax deduction.

2483 lower than the maximum sales tax in OK. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

The City has five major tax categories and collectively they provide 52 of the projected revenue. The latest sales tax rate for Tulsa County OK. State of Oklahoma 45.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. Of this 45 goes to the State of Oklahoma 1833 goes to Rogers County and the remaining 3 is allocated to the City of Claremore. The Bixby Sales Tax is collected by the merchant on all qualifying sales made within Bixby.

Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. There are a total of 469 local tax jurisdictions across the. What is the tax rate in Tulsa County.

Bixby collects a 4417 local sales tax the maximum local sales tax allowed under. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Tulsa collects a 4017 local sales tax the maximum local sales tax allowed under.

Oklahoma has a lower state sales tax than 885. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The current total local sales tax rate in Tulsa OK is 8517.

This rate includes any state county city and local sales taxes. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. For the 2020 tax year Oklahomas top income tax rate is 5.

Tulsa County collects a 0367 local sales tax less than the 2 max local sales. The Tulsa County sales tax rate is. Tulsa County Sales Tax Rates for 2022.

2020 rates included for use while preparing your income tax deduction. 2020 rates included for use while preparing your income tax deduction. 2483 lower than the maximum sales tax in OK.

The average cumulative sales tax rate between all of them is 828. Wayfair Inc affect Oklahoma. Rates include state county and city taxes.

City 365.

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma State Tax Ok Income Tax Calculator Community Tax

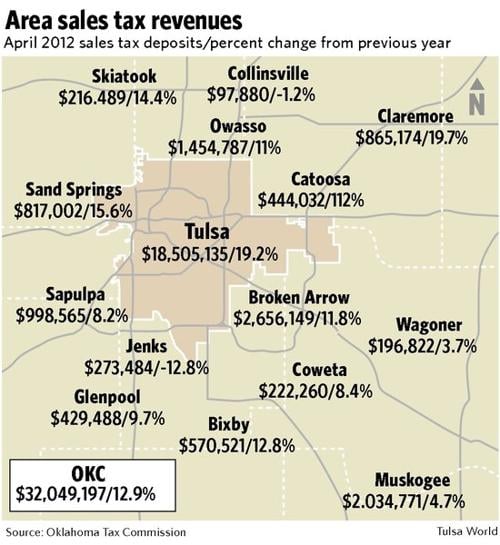

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Oklahoma Sales Tax Small Business Guide Truic

Sales And Use Tax Rate Locator

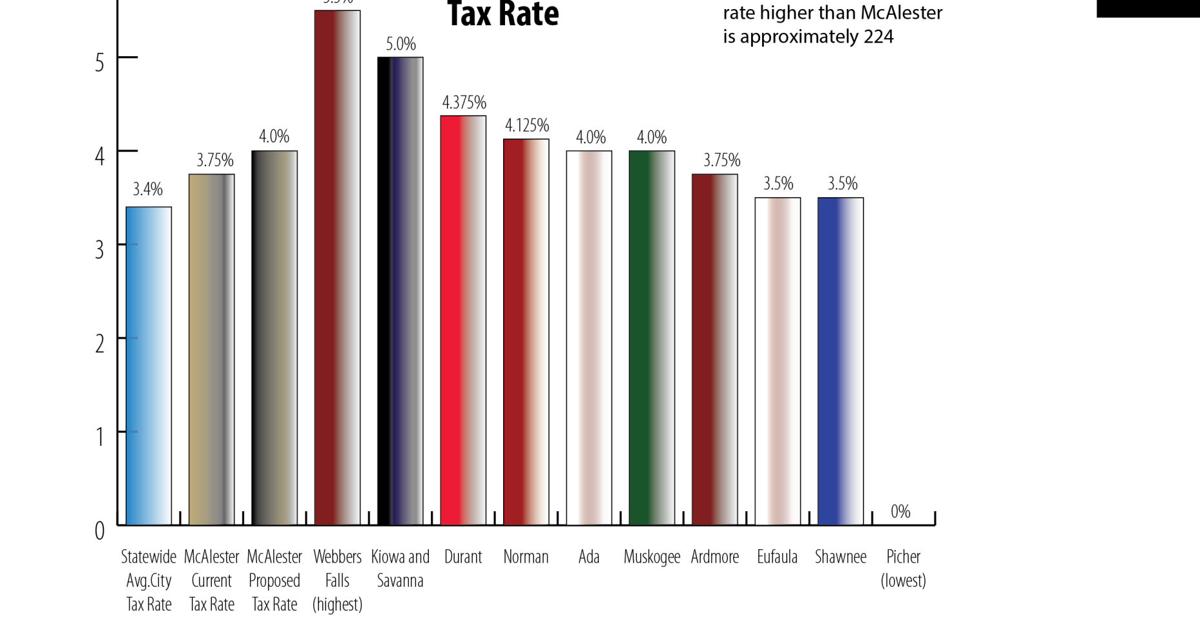

Many Sales Tax Rates Across Oklahoma Higher Than Mcalester S Local News Mcalesternews Com

How Oklahoma Taxes Compare Oklahoma Policy Institute

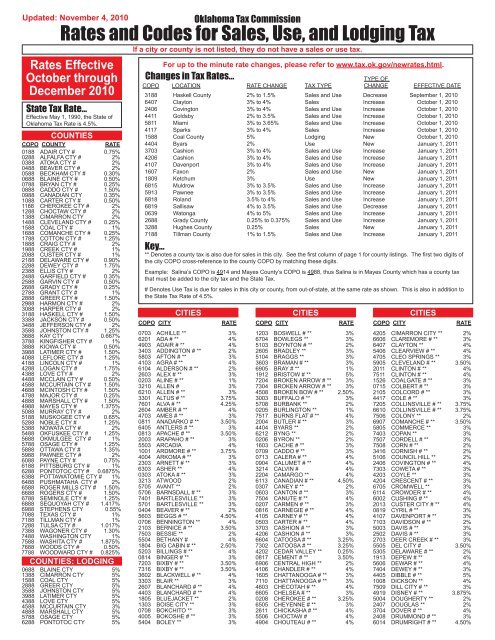

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Total Sales Tax Per Dollar By City Oklahoma Watch

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Tax Reform Faqs Top Questions About The New Tax Law Bdo

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma State Tax Ok Income Tax Calculator Community Tax

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

How To File Taxes For Free In 2022 Money

How To Calculate Sales Tax Video Lesson Transcript Study Com